At our core, we are Investment Advisors (think money management) with a strong tilt towards financial planning. We believe that investments should be aligned with individual and family goals, not some arbitrary objective that matches a stock index.

“I have been working with Frank for a few months. He has helped me transition through a difficult time in life with wise financial advice and a reassuring, confident demeanor. He has been prompt in answering questions, listens well to my needs, and takes initiative in helping me reach goals. I highly recommend his services.” – Nicole M. **

Our first few meetings start with a discovery process where clients talk about their likes, wants, and fears. These conversations lead to deeper discussions which helps our clients’ find their true purpose. Utilizing our secure client portal, we are able to track all of a client’s assets and liabilities in real-time, which allows for proactive planning based on relevant and factual information. In short, our clients see their entire financial picture in one secure place with only one login. The days of chasing down every last account to see current values is over. Convenient, yes!

Our typical client has more than $500,000 of investable assets (excluding real estate) with a net-worth greater than $3 million. Because of the complexities involved with estate planning and tax codes, we encourage a coordinated effort to work with our clients’ tax and estate planning professionals to ensure our clients remain in the most favorable financial position possible. We continue to work together through life-changing events (deaths, divorce, marriage, births, etc.) as life seemingly throws curves during challenging and unexpected times.

“As a business owner and local resident, I can say without reservations that Frank has helped me enormously with both my personal and professional lives. I have referred him to some of my closest friends; you can’t get a higher recommendation from me.” – Ivan S. **

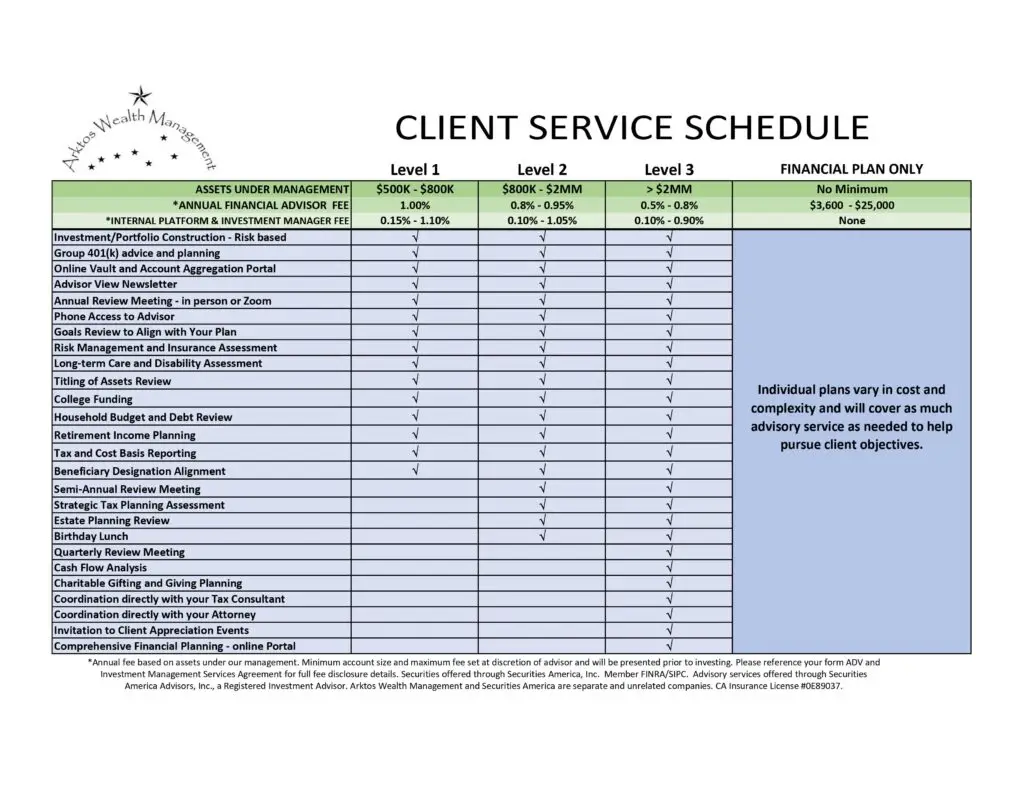

Occasionally, we have clients who are already invested elsewhere and are not looking to make an immediate change from their current investment provider. In these cases, we offer the same financial planning services by way of a “fee-only” financial planning agreement. In short, there are multiple ways we can work together (see client service schedule below).

“I’ve been working with Frank for nearly 20 years, and in that time, we’ve achieved remarkable financial milestones together. From setting up college funds for seven nieces and nephews to making decisions that allowed me to retire with nearly the same earnings as my salary, Frank has been a guiding force every step of the way. He’s always gone above and beyond, offering valuable advice on big purchases and helping to correct decisions that could have been better. I couldn’t recommend him more highly.” – Bernadine G. **

As a CERTIFIED FINANCIAL PLANNER™ practitioner, we utilize a transparent fee-based business model that is disclosed upfront to avoid surprises. We disclose any conflicts of interest to ensure we are always acting in your best interest. We are bound by our CFP ‘duty of loyalty’ to act as fiduciaries who put your interests above ours. Individual plans vary in complexity and cost, and you can be assured that you will receive value based on your needs and objectives.

In conclusion, we are not some 1960s Wall Street stockbroker with a hot-stock tip. Nor are we a commission driven insurance salesman. What you will receive is the development of a clear and personalized map to guide you through life’s beautiful journey. Come join us and let us work together to put your financial house in order!

Click anywhere below for service details: