Let’s address this perpetual issue again….and yet, again. You go to work on Monday and you find yourself surrounded by your colleagues at break/lunch time. It seems everyone is venting a laundry list of their irks and tribulations of family life, school, and those darn taxes and insurance premiums; while some are talking about the great vacation and/or dinner party they just had. In the same context, an overwhelming majority of the conversations are centered on the subject of money—and what they (your peers) would buy, what they can’t buy, and if “only they had a little more.”

Let’s address this perpetual issue again….and yet, again. You go to work on Monday and you find yourself surrounded by your colleagues at break/lunch time. It seems everyone is venting a laundry list of their irks and tribulations of family life, school, and those darn taxes and insurance premiums; while some are talking about the great vacation and/or dinner party they just had. In the same context, an overwhelming majority of the conversations are centered on the subject of money—and what they (your peers) would buy, what they can’t buy, and if “only they had a little more.”

That last line is the intrinsic nature of humans to want more, yet not want to assume the risk to get it. I don’t blame you for this greedy behavior—every one of us has a little bit to a certain extent—but you are the only one to blame when you act upon it. So when talking heads of the media and academians of the economy “pipe up” about how bad the socio-economic environment is, ask yourself if your own greed is involved in driving your decisions. If it’s not ‘greed,’ then maybe it’s greed’s cousin, “fear!”

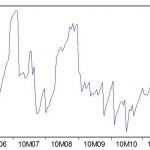

I’m not putting up a smoke screen to cover the reality of the stock market affecting your wealth. Rather, I’m emphasizing the importance of interpreting “what is happening around you,” to “how it actually affects you.” I spoke with several clients on Monday August 8th 2011 as we watched the market deliver another blow (all three market indices were about 6% down) to any possible gains made year-to-date. And for the most part, we (my clients and I) were able to make a decision based on what their goals were…and that was “to do exactly what we were already doing!” (side note: Tuesday, August 9th, 2011—the S&P 500 index posted its best daily gain in more than 2-years; 4.74%)

For those clients who have sat with me for reviews over the past several years, they know that I ask them to separate their money/wealth by risk, timelines, and goals. I call this the “bucket of money approach.”

For example: If you need a down payment on a home in the next few months, that money could possibly be kept in a savings account, 3-month Certificate of Deposit, or a Money Market account. If you have a retirement account that you can’t touch without a penalty for the next 25-years (assuming you are 35 years old), that could be invested in a well diversified portfolio of Stocks, Bonds, Real Estate, Commodities, and possibly Futures contracts. And if you had a goal somewhere in between those two examples, your investment mix would entail the risks commensurate with that timeline, and be invested in something in between the proceeding two example ‘buckets.’**

By the time you read this newsletter, I know one thing’s for sure: that the market will either be up or down from the time I’ve written it. Understanding that our financial and economic environment continually changes is a primary requisite to being an investor. Understanding the risks inherent to investing is the next step. Accepting what you can and cannot change is the third step. Controlling your emotions is the final step…and definitely my most important job!

** Disclosure: Investors should be aware that there are risks inherent in all investments, such as fluctuations in investment principal. With any investment vehicle, past performance is not a guarantee of future results. Investment strategies, including asset allocation and diversification, do not assure a profit and cannot protect against losses in a declining market.