Happy Spring time to you! Spring offers a lot to look forward to and the month of April just happens to be National Financial Literacy month…something that resonates closely with my heart and financial planning practice. Ironically, one of the most prolific demons to work his way through the financial services industry, Bernie Madoff, died on April 14th.

That man and his company cast a huge dark spell on the financial advisory profession for the foreseeable future. Mr. Madoff orchestrated a decades-long Ponzi scheme that brought an estimated $65 billion in financial damages to his institutional, but mostly, individual clients by creating fake statements, fake investments, irrelevant numbers based on real companies, and offered all this through a firm handshake and smile that provided his clients the confidence to trust him with their hard earned money.

However, without discovery of the greatest ponzi scheme ever pulled over on investors, transparency and consumer protection would not be where they are today. This is not to say there still aren’t bad actors (advisors) out there. But today’s CFPB, FINRA, SEC, and a plethora of government guidelines provide a better landscape for the masses to believe in. Add to those entities like the Financial Planning Association and the Certified Financial Planner board (both of which I belong to), and you can begin to see the significant amount of regulation and oversight that has been added to protect you, the ultimate end consumer of financial products and services.

But taking a passive approach while depending on organizations to protect you can be leaving too much on the table. Nobody has more interest in your money than you do (think about that for a quick moment). So wouldn’t it behoove you to at least educate yourself with the basics of financial literacy so that you are able to begin asking questions and inquiring deeper during conversations about mortgages, credit, investment risk, and the importance of tax and estate planning? Below, I have very briefly outlined some areas of finance and money management that many of us can review and possibly improve upon. If you’d like more information on any of these areas, I would be glad to provide you answers to help improve your financial confidence and literacy.

Earnings –

In the realm of income, your earnings are a reflection of the perceived value provided in exchange for compensation… usually made in dollars. Regardless of whether you earn $50,000 or $500,000/year, it is how you use that money that counts. What’s more interesting is how easily and quickly families can adjust to an upward trajectory, or increase, in earnings. Adjusting to a decreasing income, by contrast, is often painful and difficult.

Spending –

Spending determines and pays for your lifestyle and activities. How much research do you put into your purchases? Do you always eat out, or have to order a bottle of wine at dinner? Spending is one of the easiest things to do. Conversely, it is also one of the hardest things to control. Gambling, hedging, speculation, impulsiveness…these are characteristics that can take over your spending if not controlled.

Savings –

Saving is a conditional and learned habit. It is not in our human nature to save, and therefore requires discipline. By exercising a regimental process for saving, you will lessen the possibility of running out of money when expenses suddenly increase – for any reason. It also affords you more cushion in planning your lifestyle. Having a rainy day fund, saving for retirement, and planning for that one-week tropical vacation are all within reach if you budget accordingly.

Investing –

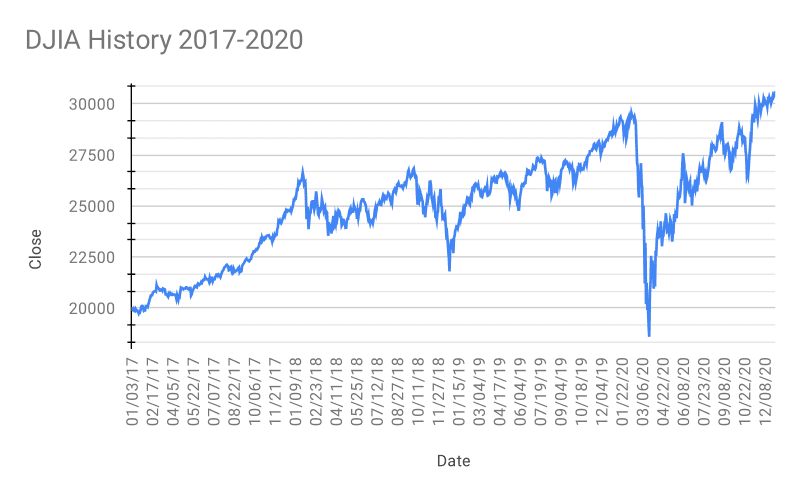

Investing is the concept of placing your money/earnings into a financial instrument or real property with the expectation its value will increase over time. You invest in education with the expectation that your (or your children’s) knowledge will command a higher salary. Investing requires planning, diligence, patience, self-control, proper research, and taking some risk. It is also one of the most difficult areas of personal finance because of the emotional aspect of being attached to your hard-earned money, and to adopt the concept of delayed gratification. This is why many people employ the services of a competent financial advisor/planner to assist them in picking appropriate investments and who work as their personal advocate to keep them from sabotaging their own plans.

Borrow –

Loans are debt and debt is a tool used to leverage your purchasing power. What may come as surprise to some, having debt is not a bad thing when used properly. Is a person with $1 million in the bank and with ‘no debt’ better off than having $2 million in the bank with $1 million in debt? While both of these two people both have $1 million of equity, one of them has twice as much exposure to asset growth potential. Proper use of debt or credit can help to amplify returns on the money you have, and the cost of borrowing this money will have everything to do with how much the lender trusts you. Building and keeping a great track record of paying your lenders on time (every time) can have a significant impact on the cost of your loans. Like they say, “money saved, is money earned.”

Planning for Transition (aka Estate and Tax Planning) –

If you haven’t been following our current administration’s proposals for gaining access to both earned income and accumulated wealth, you might want to start listening. Senator Bernie Sanders just introduced an 18-page bill called the “For the 99.5 Percent Act.” It includes federal estate tax rate increases to 45% for estates over $3.5 million and a $1 million lifetime exemption for gifts. This is a significant change from our current 40% estate tax rate for estates larger than $12,120,000.

Income tax rates are also expected to increase under the current administration’s plans. While these changes may be political pandering to one party, rules and guidelines that ultimately formalize into law see no difference in party lines come April 15th (tax-day). Discussions with your advisor, tax-professional, and estate planner can help to develop strategies to minimize the legal amount of income and estate tax you ‘must’ pay to the government.

Protection –

The final topic of financial literacy is that of risk management, a stop-loss, or better known as insurance. Insurance is one of the largest industries in the world. The sole purpose of any insurance policy is to spread each person or asset’s risk among many so that any one person or asset is not financially destroyed in the event of an experienced loss. Insurance, and the concept of spreading risk, can be applied to literally anything that has a useable value. A well-documented financial plan assesses the risk you are taking by comparing your asset values to the level of which you are protected while taking into account a certain level of risk you are comfortable with. At AWM, we discuss the importance of having a solid back stop to help indemnify you from losses that could potentially derail your entire financial plan.

Offer –

As a virtual and convenient way to express my commitment to improving our society’s financial literacy, I am providing a no-strings attached, no cost, 30-minute one-on-one Q&A meeting/discussion about anything financially related to anyone who would like to receive it. I invite parents, kids, business owners, retirees, trustees, and even your neighbor who always touts her money smarts. I’m a resource to our community, and always to my fantastic clients. Let’s clear up those questions that you’ve always wanted to ask. Let’s connect!