With proposed government spending at an all-time high, inflation and its effects may become a big factor in wealth building strategies for the next several years. To prepare for what many economists view as inevitable, here’s a few rhetorical questions to put this concept into context.

Have you ever tried paddling or swimming up a river? How about walking up an escalator that’s moving in the down direction? Or have you thought about the effect airlines are subjected to while flying into a head wind? While you may find these examples to be negligible, or exhausting in the case of the escalator, they are an excellent analogy relating to the effects we, as investors, face from the impact of inflation on our wealth and our pursuit of building it.

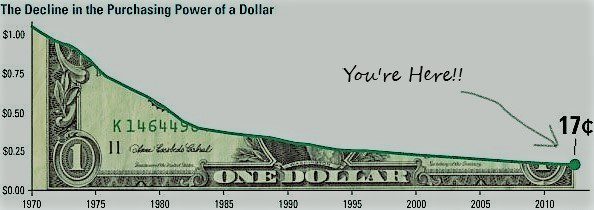

To protect the purchasing power of your wealth, it would be easy if you could grow your money fast enough to outpace inflation without taking any risk. But that concept does not exist in the world of finance. An investor always assumes some risk when trying to beat the returns of a boring old Certificate of Deposit (CD), savings account, or money market account. Today’s guaranteed return rates offered by government backed investment products are still hovering near record lows, and that makes it more important than ever for investors to consider different asset classes for higher returns–to grow faster than inflation can erode it. Racing against the real cost of inflation is an endeavor that requires a steadfast approach by investing for the long run.

For those of you who like the Ford Mustang, here’s a neat little chart showing how much (or little) you could do with guaranteed income during different periods of time with the Ford Mustang. Enjoy!

—–Ford Mustang vs. Inflation and your money—–

Another impact to wealth building – that is along the same lines of inflation – is the effect of lifestyle inflation. This is the effect of perpetually increasing the amount of spending on your lifestyle as you make more money. It is extremely common, very easy to adopt, and occurs so quietly that one may not realize it is happening at all.

Here’s a fantastic explanation (below) that may help you to identify this phenomenon of ‘life style inflation’ that could be finding its way into your pocketbook. Maybe you can relate to this, yes? Check it out….