Right now, next Christmas is closer than the past one, the days are already getting shorter, and the year is already half over? How’s that for making you feel like the year is just whizzing by? I’m not trying to depress you; I’m trying to awaken those who need a little jump start to take action on their 2024 goals, but haven’t done so.

Many people set goals and objectives based on a calendar year because it’s easy to visualize it in blocks of actual years. While that arbitrary timeline might be fine, the battle is overcoming your cognitive bias.

Cognitive biases form the basis of human decision making. They drive nearly every decision we make when it comes to a risk vs. reward outcome based on the limited input received. While quick decision making based on your instincts can save your life, those very same instincts outputs can torpedo your financial plans.

The financial service industry, along with corporate marketing firms, know all too well how an individual’s cognitive bias has a direct correlation on how people manage, save, and use their money. Furthermore, while people will justify and rationalize why a decision was made, they may not realize how their own biases could be working against them.

Some of the biggest and most recognizable stock gainers in the past year and a half have been referred to as the magnificent seven. These stocks are: Apple, Microsoft, Google, Amazon, Facebook, Tesla, and Nvidia. I’d be willing to bet that most people knew of the first six of these listed companies 10-years ago. But anyone outside the computing industry a decade ago probably didn’t know who or what Nvidia was.

In a nutshell, Nvidia makes graphical processing units (GPUs). This is the hardware which runs computing devices and possibly even the one you are viewing this blog on right now. What makes, or made Nvidia so special over the past few years is that they created the most sought after chipset that underpins 98% of Artificial Intelligence data center processors. They are on top of the world right now and this is why investors pushed Nvidia’s valuation to over $3 trillion last month.

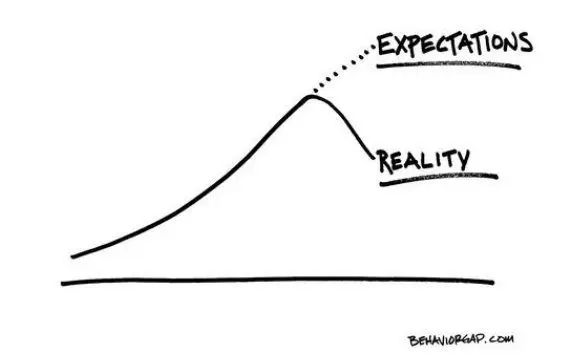

Regardless of what Nvidia did, does, or is going to do, many investors are experiencing FOMO (fear of missing out) and want to get in on this seemingly endless uptick stock ride. Who wouldn’t feel left out when their colleague at work says they are up 300% in the past 12-months or the countless newsfeed headlines state that Nvidia is single handedly transforming the world. You feel like the train left the station with you standing there – suitcase in hand.

The simple napkin sketch (below) could belie what happens over the next 6-months, a year, or 5-years from now. Or, it might just continue to rise. All we really know is that stocks go up and down and that a diversified portfolio (that might include some Nvidia stock) allows investors to participate in the growth and income of global productivity and expansion.

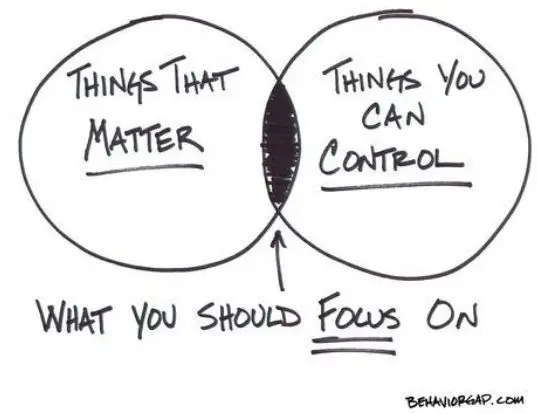

If you find yourself beginning a statement with “I just feel” or “the way I see it” when referring to something in regards to an investment, you may really be expressing a cognitive bias without even realizing it. Below is a list of common cognitive biases. Take a moment to identify which ones you rely on and how they might affect your outcome.

During investment planning and/or reviews with my clients, I have heard all of these cognitive biases (above) and more. True investors invest with purpose, an objective, and a rational basis for doing so. Basing investment decisions on emotions and feelings rarely produces success. However, when success is achieved by an emotionally driven decision, it only reinforces a cognitive bias whereas the results are expected to be repeatable. And therein lies the problem!

As we expect a more choppy stock market ride over the next several months due to an election cycle year, let cooler heads prevail. Let’s talk ‘real’ numbers based on data, not feelings, to make informed decisions on what is the right approach to building and managing your wealth today and over the long term.