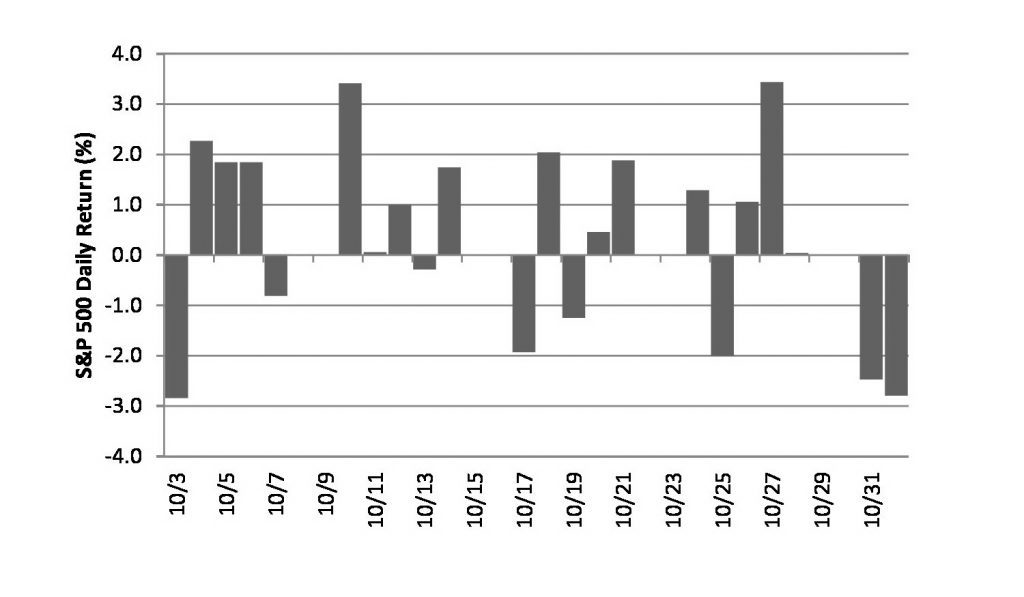

Market volatility has returned with a vengeance. As the market swings dramatically (see recent one-day returns for the S&P 500 Index below), it’s natural to worry about your investment strategy.

S&P 500 Index One-Day Return

SOURCE: Bloomberg (total returns)[1]

The good news is that we have methods that may help reduce portfolio volatility by investing in strategies designed to take advantage of up markets and approaches that historically have done better than the market on down days.

A thoughtful mix of both of these types of strategies is designed to provide a smoother ride and help mitigate deep losses that are difficult to make up. The current highly volatile market is a prime example of why diversifying portfolios across asset allocation approaches is so important. Of course, it’s important to note that past performance is no guarantee of future results.

As always, I have access to research, views and investment decisions of the institutional investment firms that are guiding allocations in your portfolio. Each of these firms continues to intelligently steer their respective strategies according to the guidelines they have agreed to implement.

Even so, it is natural to worry. If you would like to review some of the research that supports your investment strategy, I would be happy to meet with you. And, at any time, if you feel your goals, objectives or risk tolerance have changed, please call (818) 249-4984 to set up a meeting.

[1] The S&P 500 (a registered trademark of the McGraw Hill Companies) is an unmanaged basket of 500 stocks that are considered to be widely held and thus believed to be a good indicator of overall market performance. This index of common stocks is weighted by market value.