Are you keeping up with ‘the’ Jones’s? I know I’m not. Last week, I stayed in a hotel room (not disclosing name or location) which displayed its room ‘rack rate’ with an astounding $12,000 maximum daily charge. While I received a partial subsidy and paid nothing close to that eye-popping amount, I did see a Ferrari 812, and Porsche 911 GT2 RS parked on display in the circular drive.

It is at these points in life where you can find it difficult, if not outright impossible, to fathom how people can justify and afford such luxurious goods and white-gloved services. It is at these points in life where you may ask yourself, “what if I could own and partake in those same luxuries?” It is also where envy, lust, desire, greed, and many other emotions can taunt your rational self into believing that something else is better. And when you give in, it can cost you dearly.

Right now, there is a crisis at hand concerning personal debt and the financing of it. According to Experian PLC, Credit card debt is at an all-time high. At the same time, delinquency rate trends are growing for credit card holders and it reflects accordingly with ‘maxed out’ card holders.

For larger purchases like “a new car,” higher interest rates combined with higher prices over the past 2-years are now reflecting a major increase in delinquent payments-leading to a steep increase in the percentage of repossessed cars. Is this the result of satisfying a ‘want’ that one cannot afford? Or is it the result of society placing such a high value on tangible goods and services that one is willing to ruin their credit and trustworthiness to lenders in order to keep up with the Jones’s?

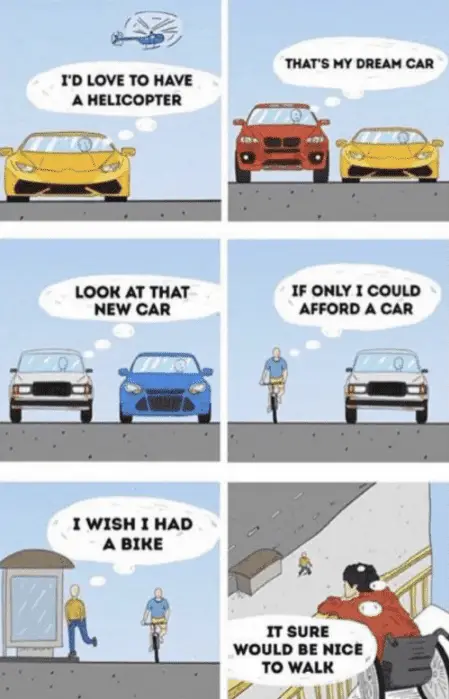

Getting back to my point about keeping up with the Jones’s, I feel that society is chasing an insatiable need/want. There is no “Jones” family to keep up with. Every one of us has peers, and each one of your peers also has peers. People get accustomed to a particular level of lifestyle, goods, and services and then strive to reach the next level out of boredom or curiosity, or a perception that something is better because it costs more.

An example, and trend that I personally have been following for nearly 2-decades, could be the current trend of master bathrooms having 2-sinks. Two-sinks in a master bathroom is practically standard for most newly designed homes. Not so long ago, a dual sink bathroom was only seen in very high-end homes; homes where ‘rich’ people lived. So the concept trickled down into virtually every newly built bathroom over the past decade.

But what takes the cake on this concept is the desire for consumers to have 2-sinks even when it’s not practical. My wife and I were just staying in a hotel where the bathroom counter was about 4-feet wide, and it had 2-sinks! There was literally no counter space to put a hair brush, make up kit, or a travel bag. But hey, the bathroom had 2-sinks!!

Below, is a pictogram showing how perception is everything in this ‘no-win’ game:

If you find yourself continually exceeding your budget or find it difficult to differentiate between wants and needs, maybe it’s time to write out a plan that works for your financial situation. At Arktos Wealth Management, we help our clients see their complete financial picture (Assets, liabilities, income, insurance, etc.) so that they know when a financial decision fits into their plan.

If you find a need to reward yourself (or someone) with a nice expensive gift, let’s make sure you have a plan to pay for it without breaking the bank!