Somewhere in the middle of the 2008 financial and real estate market crisis, I began writing a semi-monthly blog to my clients, family, friends, and prospects addressing the dark and painful, and seemingly endless, drop in global economic market valuations. This moment in time was known as our Great Recession. It was real and it was devastating for millions of American families. It would forever change the investing public’s perception of risk and trust in financial institutions in our country.

Somewhere in the middle of the 2008 financial and real estate market crisis, I began writing a semi-monthly blog to my clients, family, friends, and prospects addressing the dark and painful, and seemingly endless, drop in global economic market valuations. This moment in time was known as our Great Recession. It was real and it was devastating for millions of American families. It would forever change the investing public’s perception of risk and trust in financial institutions in our country.

There was no shortage of public commentators, news stories, and geniuses who proclaimed they predicted the financial downward spiral happening before them. The ‘Monday morning quarterback’ effect was in full swing. As people watched the equity in their homes evaporate and begin a sort of ‘sucking sound’ as the American dream of home ownership was flipped upside down, their retirement accounts were equally battered with scars as they shed 30, 40, and even 50% of their previous ‘high’ value.

Going back to the purpose of why I began writing a blog, my objective was to enlighten investors to understand that the only rational way to invest is to put markets, time, and risk into perspective. Once these basic tenets were understood and agreed upon, the only factor left to control was the behavior of my clients. Keeping someone from sabotaging their own plans by doing something (buying and/or selling) at the wrong time is the most important part of my job. This is something the day-to-day playbook used by the mainstream media would rather not discuss.

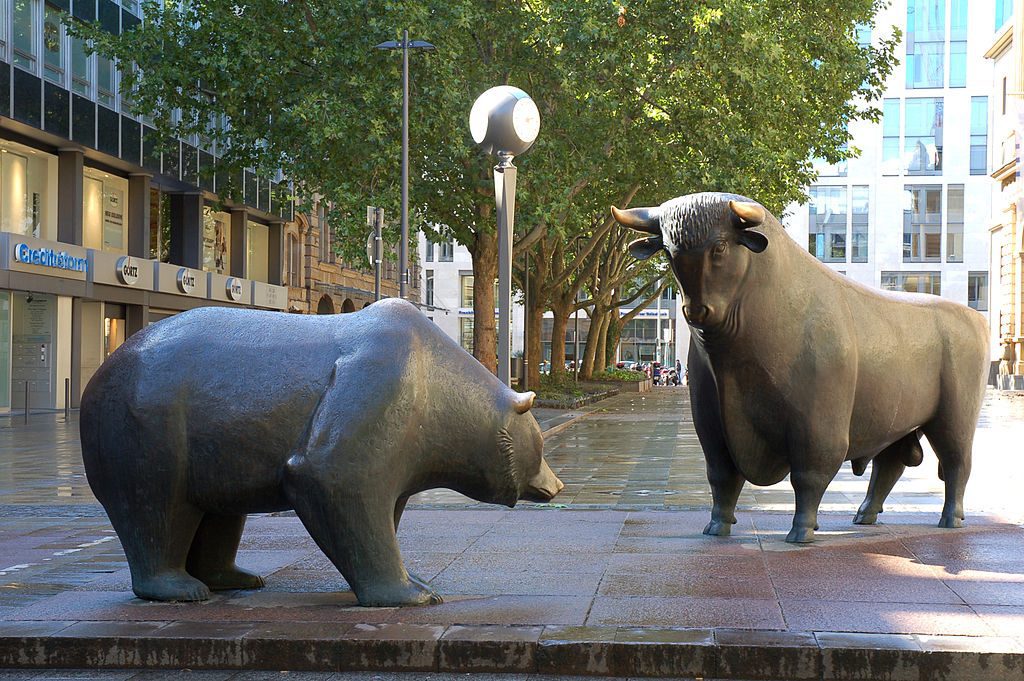

This past week, the ‘noise’ is back, and with greater abundance through multiple social media, TV, and radio outlets. The S&P 500 index dropped nearly 7% in only 3-days of trading. Scare tactics and news stories are again using words and phrases like, “Octoberphobia,” “Dow tumbles and investors are spooked,” and even “Ugly picture for bulls.” This morning, another unsubstantiated article even suggested that we are on our way to a “50% correction.” With statements like this, who wouldn’t begin to doubt their long-term plans?

After reading these headlines, I thought I would throw out some historical data to show how even a person with the worst investment luck in the world would have fared during our last great recession. And I know that many of you reading this might associate with being ‘that person’ who has the worst of luck!

Let us presume that someone, we’ll call him Bad Luckman, invested all his cash into an S&P 500 index fund 11-years ago this month on the exact day the S&P 500 hit its highest level in history (up to that day): 1,561. If Bad Luckman remained in his investment and watched it drop by 51% over the next 17-months (that’s how much the S&P 500 index dropped over that period), and rode it out until today, he would be up about 80%*…and that includes the recent 7% decline. Today, (10/16/18), after last week’s major sell-off, the S&P 500 index closed at 2,809.

In reality, having the same bad luck as “Bad Luckman” would be a hard act to follow, just as it would be nearly impossible to know exactly when to get out of the market. If you think you can pick the right time to get out, and again, the right time to get your money back in the market, then by all means, write a book and start an investing show. If you’re right, I’ll look forward to celebrating the christening of your new 100-foot yacht purchased with the proceeds of your winning formula.

But if you’re like 99.9% of investors and money managers who cannot predict the day-to-day movement of the markets, maybe you just need a guide to keep you from making an emotionally charged decision that goes against your investment goals based on a specific timeline and risk tolerance. The stock market moves up and down every trading day, and typically trends in one direction. If you want to discuss why your account value is moving the way it is, or if you aren’t comfortable with the size of the movement, give me a call to discuss. I can hopefully put it all back into a perspective that makes sense to you.

*This is a hypothetical illustration, which may not be used to project or predict investment results. The S&P 500 Stock index is a widely recognized, unmanaged index of common stocks. Past performance is no guarantee of future results. Average annual returns assume the reinvestment of all distributions and/or dividends. Indices are unmanaged, statistical composites and their returns do not include payment of any sales charges or fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index.